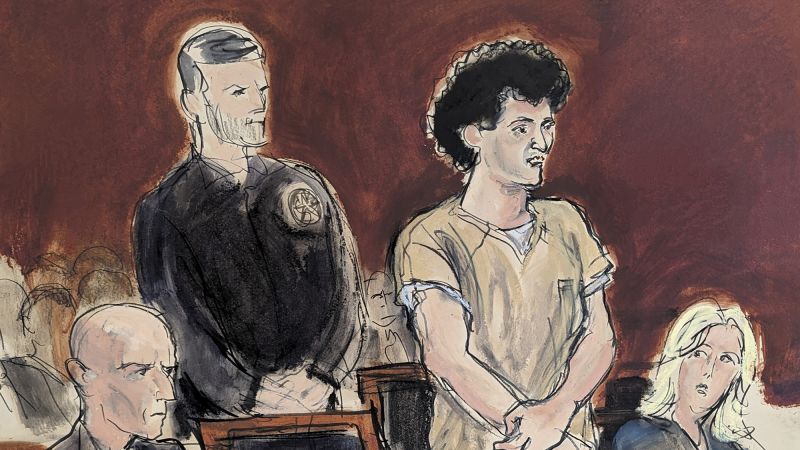

Sam Bankman-Fried, the founder of the crypto startup FTX, was sentenced to 25 years in prison after being found guilty of fraud and conspiracy. This outcome was not a surprise, as a prison sentence was expected after the jury’s verdict in November. The key takeaway from the hearing was that Bankman-Fried’s sentence was half of what prosecutors had sought, with Judge Lewis Kaplan considering factors like the crimes’ brazenness and the potential for future criminal behavior.

Judge Kaplan recommended that Bankman-Fried be placed in a medium-security facility, ideally in San Francisco to allow for family visits. While there is no parole in federal cases, good behavior can result in time off a sentence, potentially reducing Bankman-Fried’s time served to as little as 12.5 years. Bankman-Fried addressed the court before his sentence was revealed, expressing regret for his actions as FTX’s CEO and acknowledging the impact on his former business partners and customers.

In addition to the prison sentence, Bankman-Fried was ordered to forfeit $11 billion in assets acquired with stolen customer funds. This forfeiture will be paid over time, potentially consuming the majority of Bankman-Fried’s future earnings. Judge Kaplan emphasized that the forfeited assets would be used to help repay victims of the FTX collapse. Bankman-Fried argued that there was no loss to customers because of potential fund recovery, but Kaplan dismissed this claim as misleading and speculative.

FTX is now under the oversight of corporate restructuring expert John J. Ray III, who described the company as not being solvent or safe. Ray’s team has been working to recover assets over the past 18 months, which may benefit former customers and creditors. Judge Kaplan’s decision and Bankman-Fried’s sentencing reflect the severity of the crimes committed and highlight the importance of accountability and restitution for victims. Bankman-Fried’s case serves as a cautionary tale for those involved in the crypto industry and underscores the consequences of fraudulent behavior in financial markets.