The new pre-filled income tax return is coming: from April 30th, taxpayers will be able to view the new simplified 730 form, which can then be submitted starting from May 20th. The deadline to submit the return is until September 30, 2024; for those filing the Redditi model, the deadline is until October 15. To view and download the declaration, taxpayers need to access their reserved area with Spid, Cie, or Cns. It will also be possible to delegate a family member or a trusted person directly from the reserved area on the Revenue Agency’s website. The traditional alternative will still be available.

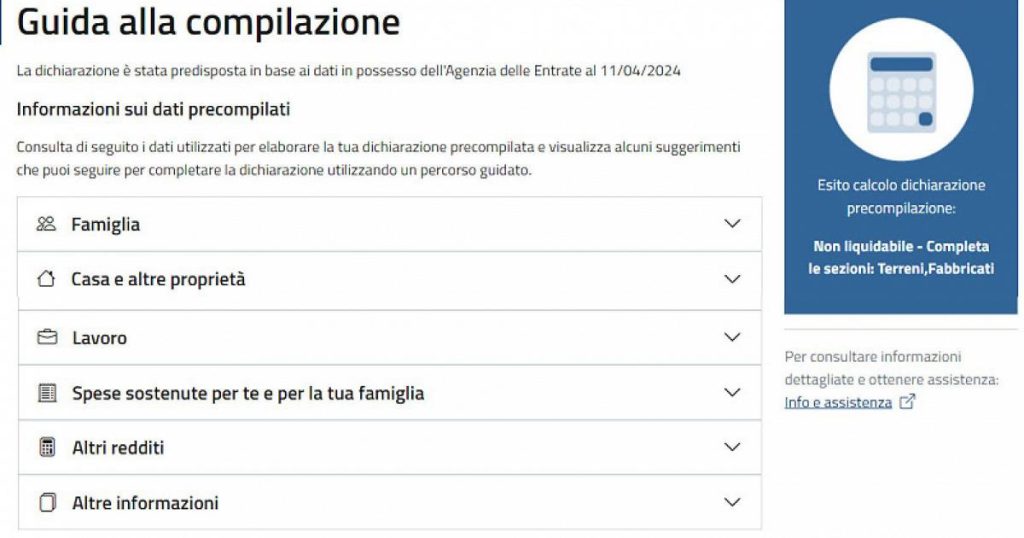

The format of the new pre-filled tax return will eliminate grids, codes, and rows, replacing them with simple sections. Taxpayers will be guided by a more intuitive interface and plain language, where data already in the possession of the Revenue Agency or acquired from employers, pharmacies, banks, and other sources will be collected. Information related to housing (rental income, lease contracts, mortgage interests, etc.) will be gathered in the new ‘home’ section, deductions in the ‘expenses incurred’ section, and family information in the ‘family’ section. The tax authorities have pre-loaded almost 1.3 billion data items, with the majority being healthcare expenses, followed by insurance premiums, employee and self-employed income statements, renovation payments, mortgage interests, and school expenses.

One of the new features this year is the ability to receive any 730 refunds directly from the Agency, even with a withholding agent, by selecting the ‘no substitute’ option. This option also applies if there is a tax debt revealed in the return; in this case, the taxpayer who submits the return can make the payment through the same online application. The procedure allows the F24 to be charged to the same Iban indicated for the refund. Alternatively, the pre-filled F24 can be printed and payment can be made through the regular channels. Additionally, new items such as refunds for the ‘vision bonus’, information sent by pediatric nurses, and local public transport subscriptions have been added to the previously available categories (pension contributions, university expenses, daycare expenses, renovation works, charitable donations).

Starting this year, business owners and professionals will also be able to consult the pre-filled declaration containing income from self-employment certificates, properties and lands, deductible and deductible expenses, and those of family members. Furthermore, in case of opting for the benefit regime or the lump-sum regime, it will be possible to complete and submit the individual income tax return directly through the pre-filled application, and starting from June 15th, opt for a preventive agreement.