The Green Finance Institute (GFI) in the UK, supported by Defra and the HM Treasure, has conducted a groundbreaking analysis on the impact of nature degradation on the economy. This analysis reveals that nature degradation could cost the UK 12% of its GDP, which is equivalent to the impact of major economic shocks like the global financial crisis of 2008 or the Covid-19 pandemic. This quantification of the economic impact of nature degradation using a macro-economic model provides insight for corporates, investors, and policy-makers on the potential risks and consequences for the economy.

The connection between nature and the economy is fundamental, as ecosystem services provided by nature impact various aspects of society and the economy, such as food production, climate regulation, and mental health. The risks posed by nature degradation interact with each other and present significant threats that could impact the UK within the next decade. Global GDP is highly dependent on nature, with over half of it exposed to nature risk, totaling $58 trillion. The Kunming-Montreal Global Biodiversity Framework, agreed upon at the UN biodiversity summit in 2022, aims to safeguard nature and address these risks.

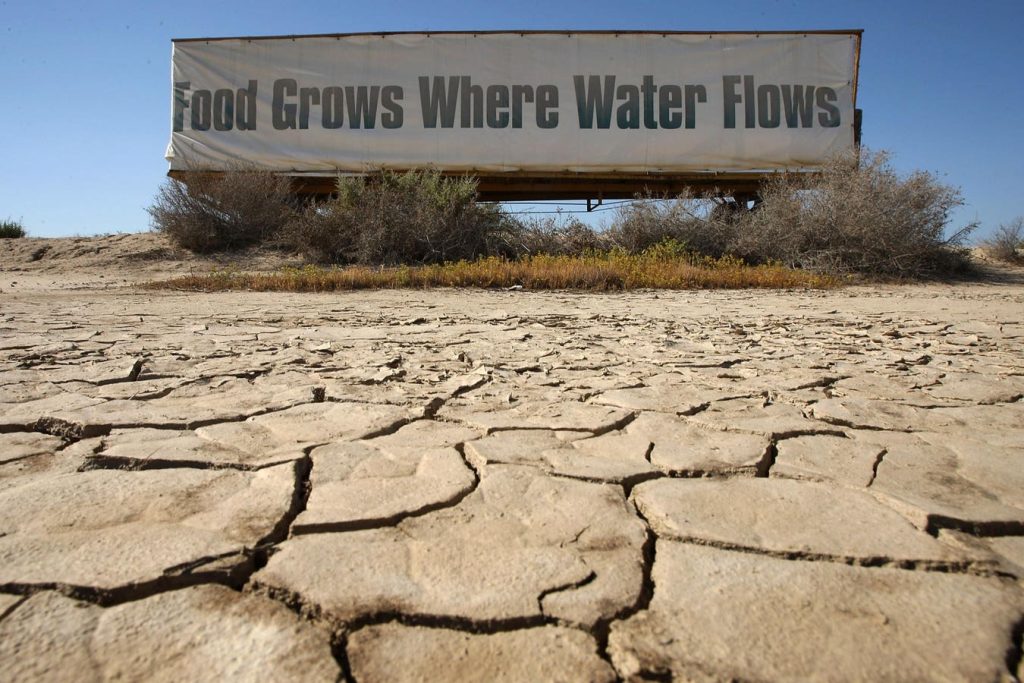

The analysis identifies specific financial risks arising from nature degradation, including soil health decline, water shortages, food security repercussions, zoonotic diseases, and antimicrobial resistance. Sectors such as electricity generation and agriculture are particularly vulnerable to nature-related financial risks, which could impact production, prices, and financial stability. Financial institutions are also exposed to nature-related risks, with potential reductions in the value of domestic portfolios leading to financial resilience challenges. However, current prudential policies and risk management practices do not adequately account for nature-related risks.

Incorporating nature-related risk into reporting frameworks, such as the Taskforce on Nature-related Financial Disclosure, is essential for businesses to understand their reliance on nature, assess material risks, and identify opportunities for action. Early action to mitigate nature-related risks can bring immediate benefits for the economy by reducing physical nature-related risks. Addressing supply chain risks overseas is crucial for businesses, as half of the UK’s nature-related financial risks originate from international sources.

The report highlights the urgency of addressing risks from environmental degradation and biodiversity loss, which are just as severe and urgent as those from climate change. Acting now to mitigate nature-related risks is crucial to prevent irreversible ecological tipping points and secure measurable benefits for people, planet, and prosperity. Understanding the analysis and taking necessary actions to tackle both GHG emissions and nature degradation simultaneously is critical to safeguarding the economy and environment for the future.