The Dow Jones Industrial Average experienced significant losses last week, with more than 400 points shaved off in two days, resulting in a total drop of over 900 points for the week. This volatility has continued into the current week, with another close in the red on Monday despite an early uptick. However, this kind of short-term setback is a common occurrence when investing in stocks.

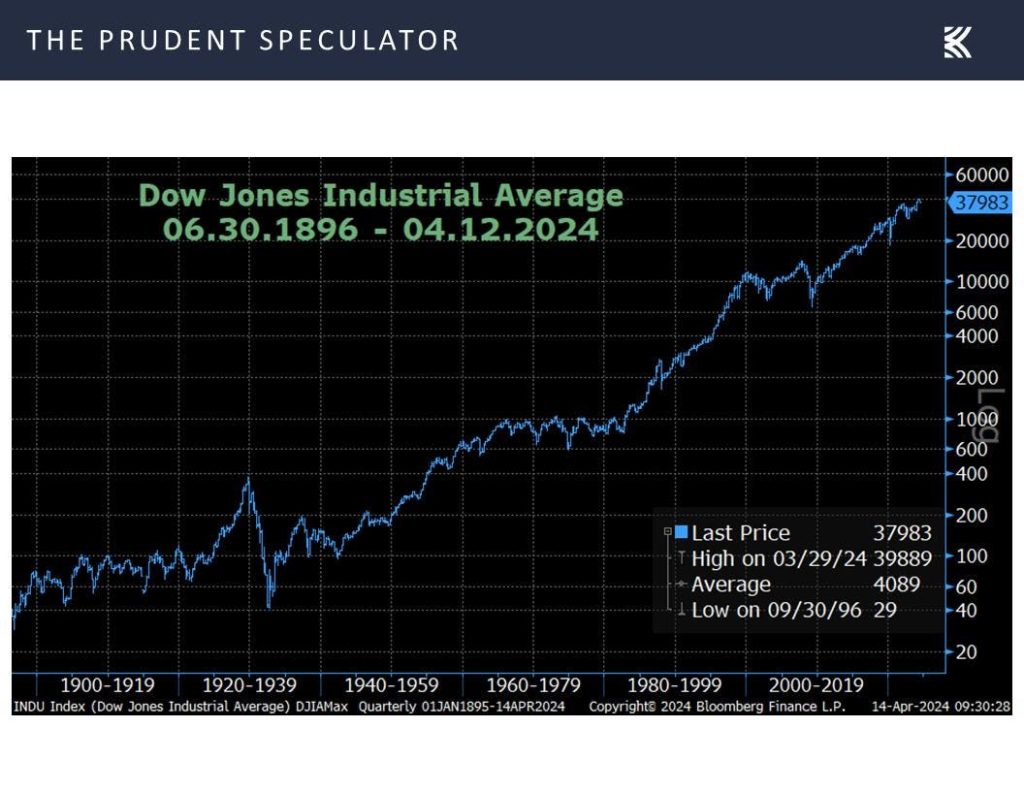

Despite these fluctuations, a long-term view of the Dow shows a consistent upward trend. Looking at the S&P 500 dating back to 1928, regular drops of 5% or more, corrections of 10%, and Bear Markets of 20% have occurred with certain frequencies. Last week, traders were also concerned about higher-than-expected inflation in the Consumer Price Index for March, with both the CPI and core CPI rising above estimates.

Many traders have been reacting to the inflation data by betting on Fed rate cuts and lower bond yields, resulting in a sell-off in stocks. However, historical data shows that equities have performed well over the long run regardless of inflation levels. Even Value stocks have historically done well after CPI readings above the median inflation rate of 2.7%.

In terms of individual stocks, Citigroup released its Q1 financial results last week, surpassing earnings expectations but experiencing a drop in share value. The bank reported restructuring charges aimed at simplifying its organizational structure, which is expected to yield significant cost savings in the future. CEO Jane Fraser highlighted the progress made in simplifying the management structure and focusing on transforming the business for improved efficiency and client experience.

Despite some recent gains in its share price, Citigroup’s potential for long-term upside remains strong, trading at a low multiple of earnings and below tangible book value. The bank’s commitment to expense reductions and operational improvements bodes well for its future performance. Overall, the market seems to be recognizing Citigroup’s efforts to transform and streamline its operations, making it a promising investment opportunity.