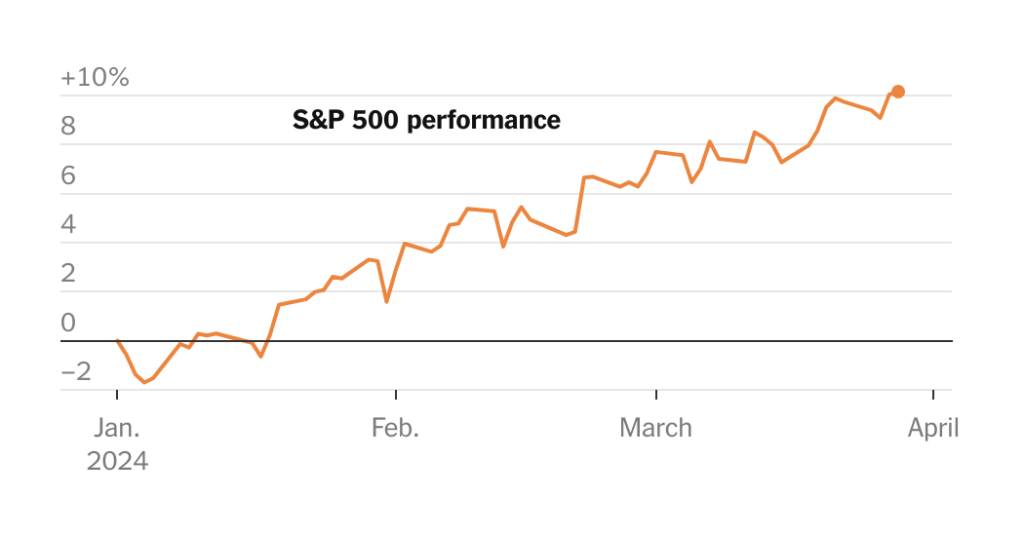

The stock market had a strong start to 2024, with the S&P 500 rising over 10 percent in the first three months and hitting 22 record highs. Around 40 percent of the stocks in the index are trading above their levels from a year ago, showing strong performance across various sectors. Even on days when the index fell, it was not by much, with only three days in the year so far where the S&P 500 dropped by more than 1 percent. Investor confidence in stocks has also been growing, with $50 billion being poured into funds that buy stocks in the United States in March.

The initial rally in January was driven by expectations that the Federal Reserve would start cutting interest rates, but this has shifted to a more widespread optimism that the central bank can bring inflation down to 2 percent without harming the economy. This optimism has extended to riskier areas of financial markets, with Bitcoin trading above $70,000 for the first time and increased merger and takeover activity. Credit markets have also seen a surge in demand to borrow and lend money, reflecting a positive outlook for corporate America.

While the Fed may consider cutting interest rates multiple times in 2024, the returns available to investors in the US remain attractive compared to other global markets, leading to continued investment inflows. However, there are signs of caution, as cracks are beginning to emerge in the economy. Consumer finances are showing signs of strain, with rising credit card debt and delinquencies on car loans. Additionally, the number of companies defaulting on their debts has more than doubled in the past year, indicating potential challenges ahead.

The Russell 2000 index, which tracks smaller companies more closely tied to the domestic economy, also saw a modest increase of 4.3 percent in the first quarter. This suggests that larger companies, particularly those involved in artificial intelligence, are driving the overall market growth. The top-performing stocks from last year, including Nvidia, Meta, Amazon, and Microsoft, continued to have a significant impact on the market, accounting for half of the S&P 500’s gains in the first three months of 2024. Strong corporate earnings, stable interest rates, and high employment rates are contributing to the market’s upward movement.

Overall, the stock market has been performing well in the first quarter of 2024, with the S&P 500 hitting new highs and attracting investor interest. Despite concerns about the economy and signs of financial strain among consumers and companies, confidence in stocks remains high. The ongoing optimism around the Federal Reserve’s monetary policy, strong corporate earnings, and consumer spending habits are seen as key drivers of the market’s upward trajectory. However, with uncertainties still looming, some experts caution about the potential for troubles ahead and advise investors to stay vigilant.