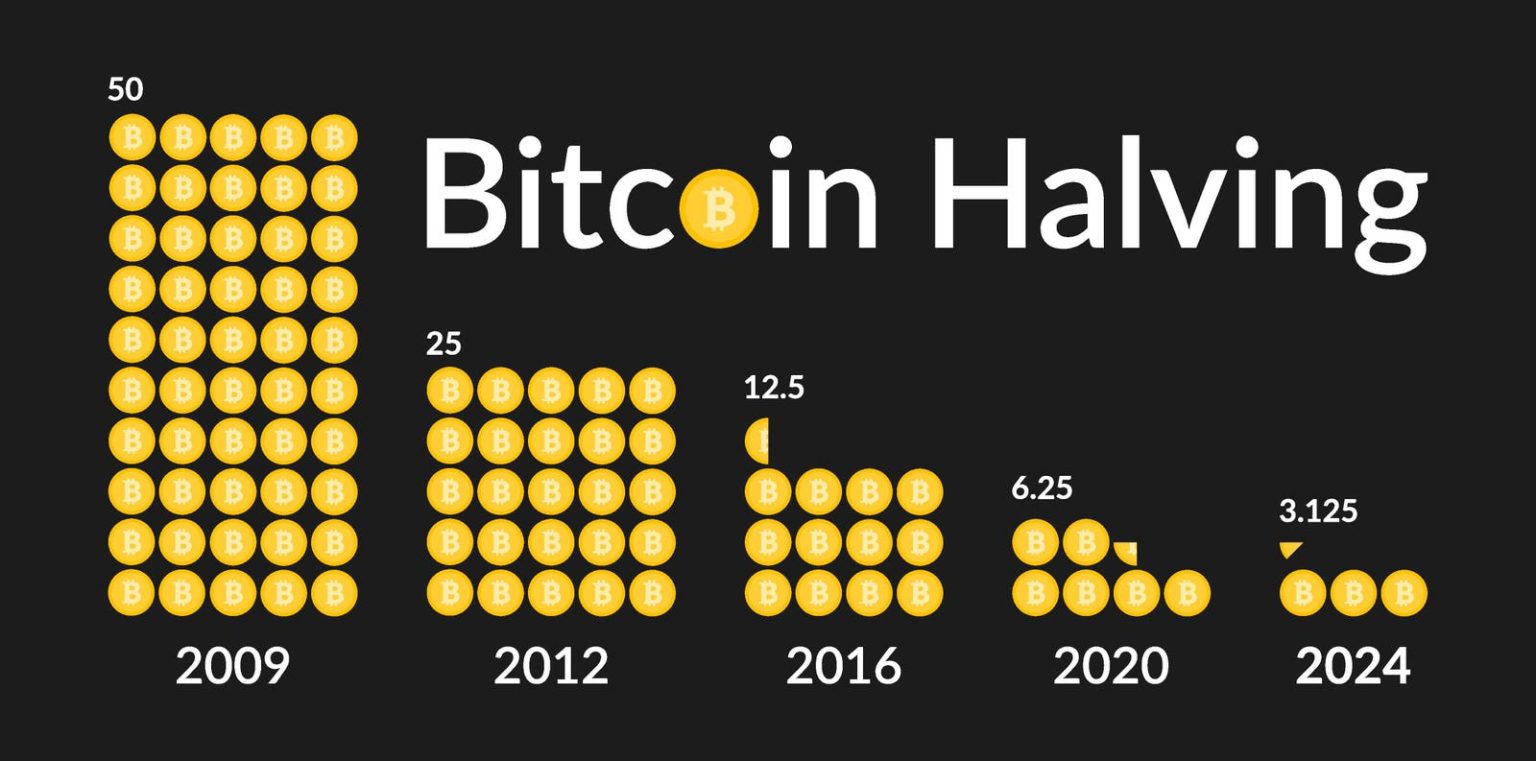

The Bitcoin halving event, which occurs every four years, is set to take place in April 2024. This event is significant as it reduces the rewards for miners who confirm transactions on the blockchain by half. In the past, Bitcoin halving events have been associated with an increase in the price of Bitcoin as the supply decreases and demand remains constant or increases. This has led many investors to consider whether or not they should invest in Bitcoin leading up to the halving event.

Investing in Bitcoin can be a risky endeavor as the price of the cryptocurrency is highly volatile. However, many investors believe that the potential for price appreciation following the halving event makes it a compelling investment opportunity. Supporters of Bitcoin argue that the fixed supply of 21 million coins means that as demand increases, the price of Bitcoin is likely to rise. Additionally, Bitcoin is increasingly being seen as a hedge against inflation and economic uncertainty, further driving interest in the cryptocurrency.

On the other hand, skeptics caution against investing in Bitcoin due to its lack of regulation and the potential for price manipulation. They argue that the cryptocurrency market is speculative and investors should proceed with caution. Additionally, some critics believe that the halving event may already be priced into the market, meaning that the expected price increase following the event may not materialize. These factors have led some investors to question whether or not they should allocate a portion of their investment portfolio to Bitcoin.

Despite the differing opinions on investing in Bitcoin, it is clear that the cryptocurrency market continues to attract significant interest from both retail and institutional investors. Major companies such as Tesla and Square have added Bitcoin to their balance sheets, and more traditional financial institutions are exploring ways to offer cryptocurrency services to their clients. This increasing acceptance and adoption of Bitcoin could potentially drive further price appreciation, making it an attractive investment option for some investors.

As the April 2024 Bitcoin halving event approaches, investors are left to grapple with the decision of whether or not to invest in the cryptocurrency. While the potential for price appreciation following the halving event is enticing, the inherent risks of investing in a highly volatile asset like Bitcoin cannot be ignored. For those considering investing in Bitcoin, it is important to carefully research and understand the risks involved, and to consult with a financial advisor to determine if Bitcoin aligns with their investment goals and risk tolerance.

In conclusion, the April 2024 Bitcoin halving event presents an interesting opportunity for investors to potentially capitalize on the anticipated price appreciation of the cryptocurrency. However, investors should proceed with caution and carefully consider the risks and benefits of investing in Bitcoin before making any decisions. Whether or not to invest in Bitcoin ultimately depends on an individual investor’s risk tolerance and investment objectives, as well as their overall investment strategy.