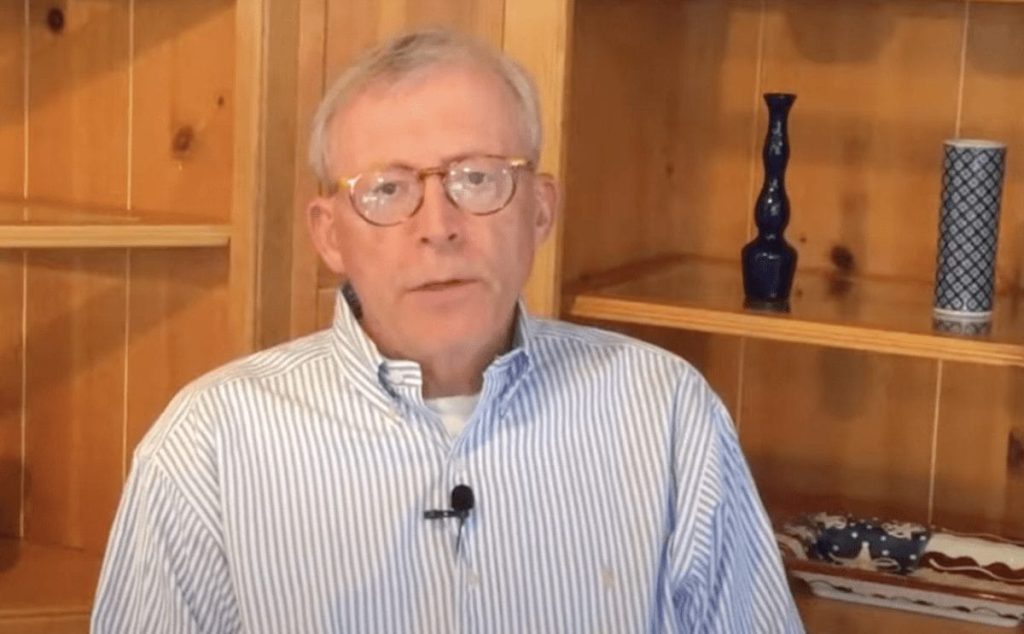

Veteran trader Peter Brandt recently suggested the probability of an upward price trajectory for Bitcoin on April 18, citing recurring patterns in its market behavior. His analysis showed that Bitcoin prices tend to follow a repeating pattern, suggesting a bullish trajectory. Brandt classified Bitcoin into three phases: Hump-Slump, Bump-Rump, and Pump-Dump, with the current market being in the third phase. He noted that the “dump” part had already occurred, while the “pump” phase was yet to materialize, indicating a potential increase in BTC price. This analysis comes at a time when the cryptocurrency market is experiencing a bearish trend due to geopolitical tensions between Israel and Iran.

During a recent retaliatory attack by Israel on Iran, Bitcoin briefly dipped in price before recovering, indicating a potential altcoin rally. Additionally, CryptoQuant data suggests that large Bitcoin holders may have used the price dip to accumulate more cryptocurrencies. A significant transfer of over 27.7K BTC into accumulation wallets occurred between April 16 and April 17, exceeding previous records. The impending Bitcoin halving event, designed to reduce mining incentives and slow down new Bitcoin creation, further strengthens Brandt’s Bitcoin price prediction.

Peter Brandt’s optimistic view on a potential BTC price increase is supported by other market experts, such as pseudonymous trader Rekt Capital. Rekt Capital suggested that the current dip period of BTC may be the last opportunity for holders to purchase Bitcoin at a relatively low value before post-halving sets in. Recent BTC price movement features are said to be similar to previous Bitcoin halving cycles, where price declines were followed by rallies. Rekt projected a “re-accumulation phase” following the halving event and mentioned that this phase historically lasts over a year, yet could be shorter this time due to current market conditions.

In a tweet on X, Rekt Capital outlined the three phases of the Bitcoin halving and noted that Bitcoin has experienced two -18% retraces prior to the halving event. These retraces were followed by recoveries to higher prices, indicating a potential bullish trend for Bitcoin post-halving. Rekt Capital also suggested that the re-accumulation phase following the halving event could be shorter than historically seen, leading to a quicker BTC price increase compared to previous cycles. With both Brandt and Rekt Capital’s analysis aligning with the potential for a BTC price increase, investors and traders are keeping a close eye on the cryptocurrency market for any significant developments.