The first quarter of 2024 was a strong one for stocks, with the S & P 500 jumping 10.16% over the first three months and hitting a series of all-time highs. The Dow Jones Industrial Average and Nasdaq also had strong performances during the quarter. Strong U.S. economic data and investor excitement around artificial intelligence helped propel many technology stocks higher. During the quarter, the investing club initiated two new positions, took advantage of buying opportunities, and booked profits in outperforming stocks when necessary.

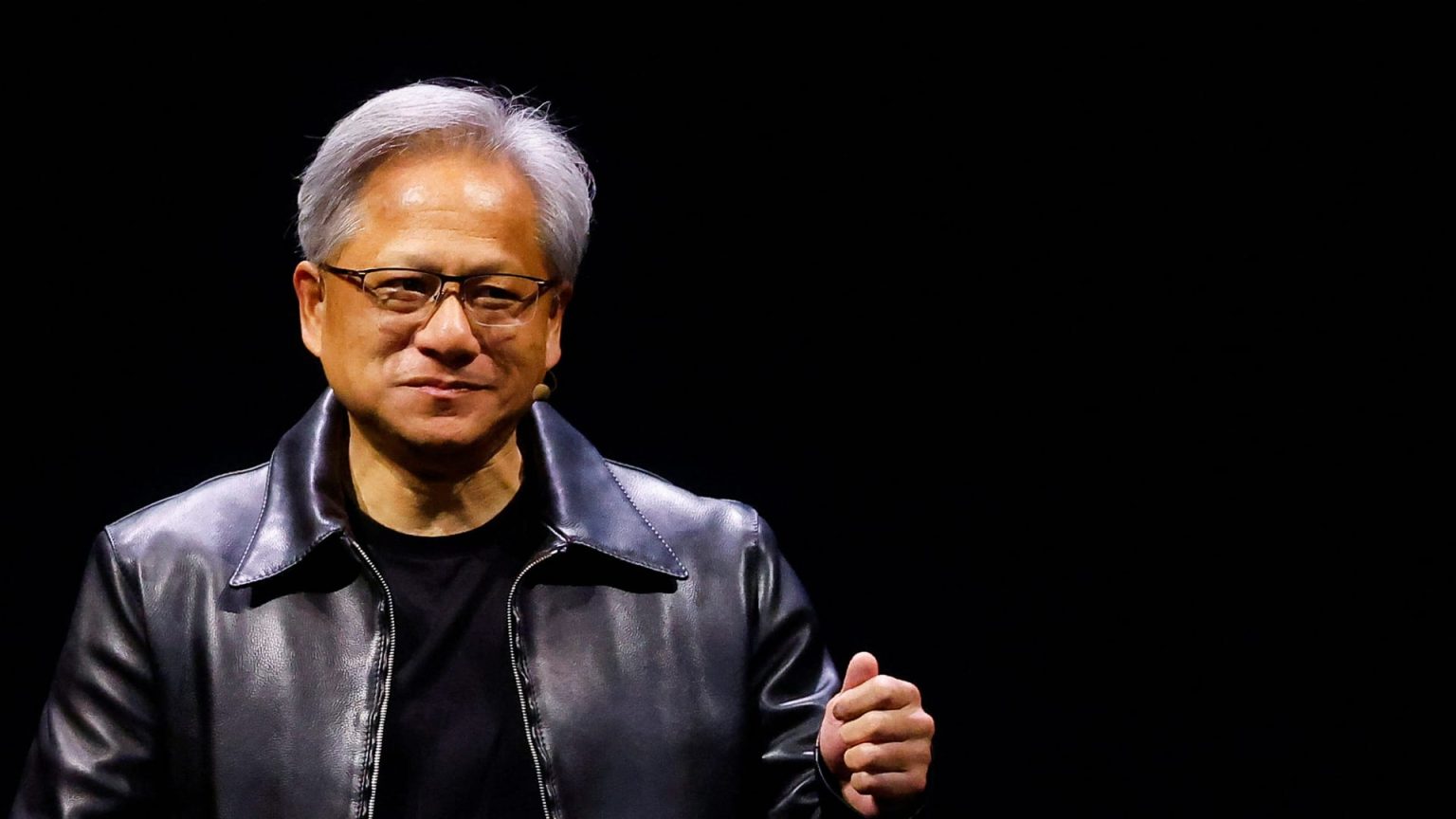

The top performers during the first quarter of 2024 included Nvidia, which jumped 82.5%, Meta Platforms, which climbed 37.2%, Walt Disney, which rose 35.5%, and Eli Lilly, which increased 33.5%. Nvidia continued to ride the wave of investor enthusiasm for generative AI, while Meta Platforms received a boost after declaring its first-ever quarterly dividend and issuing strong results and guidance. Walt Disney’s gains came amidst an ongoing proxy fight with activist investor Nelson Peltz, while Eli Lilly’s growth prospects in the GLP-1 drug category were celebrated by Wall Street.

On the flip side, Apple was the worst-performing stock in the portfolio, dropping 10.9% during the first quarter. Concerns around softening demand for its flagship device in China and regulatory issues weighed on the stock. Foot Locker was the second-worst-performing stock, declining 8.5% after a steep sell-off following disappointing quarterly results. Starbucks also faced headwinds in key markets, causing its stock to drop 4.8%. Palo Alto Networks rounded out the list of laggards, falling 3.7% after cutting its full-year revenue guidance and shifting its business strategy.

Despite the challenges faced by some of the laggards, the investing club remains confident in its approach and continues to monitor the market for opportunities. Jim Cramer, the club’s leader, reaffirmed his confidence in certain stocks like Meta Platforms and Eli Lilly during the Monthly Meeting, while also acknowledging concerns about stocks like Foot Locker and Starbucks. The club remains committed to its investment theses and will adjust its positions as necessary to maximize returns for its members.

As a subscriber to the CNBC Investing Club with Jim Cramer, members receive trade alerts before Jim makes a trade. Jim follows a specific protocol when trading stocks in his charitable trust’s portfolio, waiting a certain amount of time after issuing a trade alert before executing the trade. Members are reminded that no specific outcome or profit is guaranteed, and they should review the terms and conditions, privacy policy, and disclaimer provided by the club.