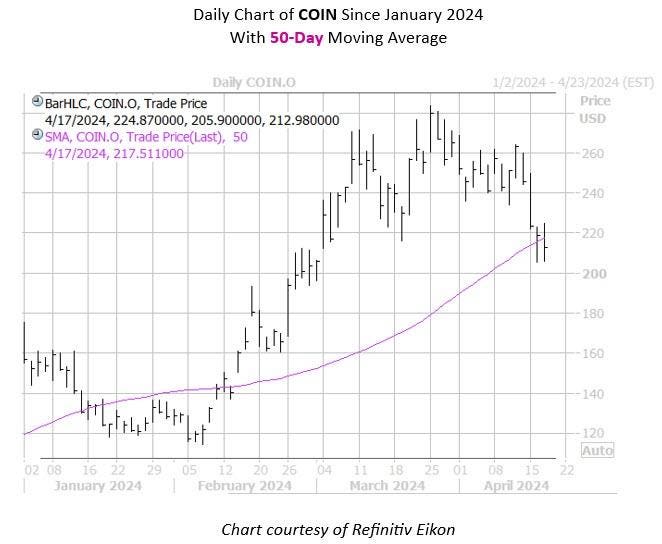

Coinbase Global (COIN), a leading blockchain and Bitcoin (BTC) platform, has been struggling in the second quarter of the year, with a 19% drop in April and a 25% decrease from its March 25 two-year high of $283.48. However, there is hope for a potential bullish trend as the equity approaches a historically bullish trendline. Senior Quantitative Rocky White’s data shows that COIN has come within one standard deviation of its 50-day moving average, with three similar signals in the past three years resulting in a 67% chance of being higher one month later, with an average gain of 11%. A move of similar magnitude from its current price of $212.27 could put the shares at roughly $235.61.

A short squeeze could further fuel COIN’s potential bounce back, as short interest has fallen 10% in the two most recent reporting periods. However, there are still 11.63 million shares sold short, accounting for a healthy 6.3% of COIN’s total available float. Despite the recent drawdown, the security is up 22% in 2024, which could prompt analysts to change their ratings. Currently, 12 out of the 20 analysts in coverage maintain “hold” or worse ratings on COIN.

Options trading could be the preferred route for investors interested in Coinbase Global stock, as the Schaeffer’s Volatility Scorecard (SVS) for COIN stands at 76 out of 100. This indicates that the stock has exceeded option traders’ volatility expectations in the past 12 months, making it a favorable environment for premium buyers. With the potential for a short squeeze and a historically bullish trendline, options traders may find opportunities to capitalize on COIN’s potential upside.

Investors and analysts will be closely watching Coinbase Global’s performance in the coming weeks as the company navigates the volatile cryptocurrency market. With the possibility of a bounce back from current levels, there could be potential opportunities for traders to profit on COIN’s recovery. As the cryptocurrency industry continues to evolve and grow, companies like Coinbase Global will play a crucial role in shaping the future of digital assets and blockchain technology.