The Missouri lawmakers have approved a bill aiming to expand a low-interest loan program for farmers and small businesses to meet the increasing demand for government aid amidst high borrowing costs. Under the program, states deposit money in banks at below-market interest rates, allowing banks to provide short-term, low-interest loans to specific borrowers such as farmers and small businesses. This initiative comes in response to the Federal Reserve’s efforts to combat inflation by raising interest rates to a 23-year high of 5.3%, making all loans more expensive. The linked-deposit programs can reduce borrowers’ interest rates by an average of 2-3 percentage points, potentially saving them thousands of dollars.

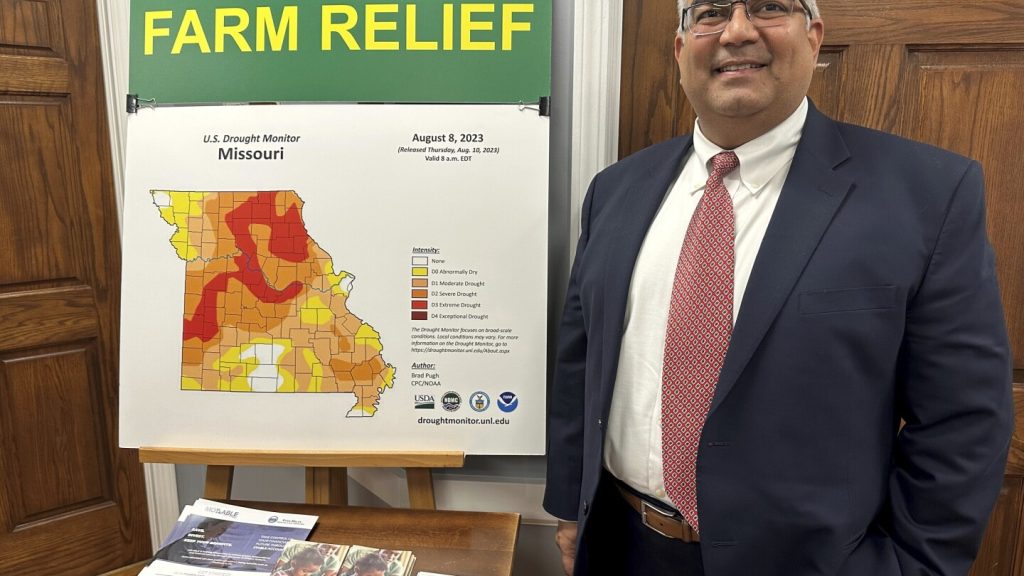

Missouri Treasurer Vivek Malek experienced a surge in requests for the program when he opened up the application window earlier this year, leading him to close it the same day. As a result, Malek proposed legislation to increase the program’s cap from $800 million to $1.2 billion, which has now passed and is awaiting Gov. Mike Parson’s approval. Malek highlighted the program’s popularity among farmers, ranchers, and small businesses, especially during times of high interest rates. The expansion may cost the state $12 million in potential earnings, but the economic activity generated from the loans could help offset some of those costs, according to a legislative fiscal analysis.

Not all states have similar loan programs, but neighboring Illinois is among those with a robust program. In recent years, Illinois has seen a significant increase in low-rate deposits for agricultural loans through its agricultural investment program, with Treasurer Michael Frerichs raising the program’s overall cap to $1.5 billion. This trend in state-backed low-interest loan programs reflects a growing public interest in leveraging taxpayer funds to stimulate private investment and provide support to farmers, small businesses, and individuals facing the challenges of high borrowing costs.

The timing of these expansions in low-interest loan programs coincides with the Federal Reserve’s efforts to combat inflation by raising interest rates. The record-high benchmark interest rate of 5.3% has made borrowing more expensive for individuals and businesses seeking loans for various purposes. By offering linked-deposit programs, states like Missouri and Illinois are able to provide financial relief to borrowers in key sectors such as agriculture and small business, helping them navigate the challenging economic landscape created by the high interest rates in place.

The Missouri legislation expanding the low-interest loan program reflects a proactive approach by state policymakers to address the financial needs of farmers, ranchers, and small businesses. Recognizing the importance of access to affordable credit in stimulating economic growth, these programs play a crucial role in supporting and empowering individuals and businesses to pursue their goals and contribute to the overall well-being of the economy. With the increased demand for government aid in the form of low-interest loans, initiatives like the MOBUCK$ program in Missouri and similar programs in neighboring states are essential in fostering resilience and stability in the face of ongoing economic challenges.

As states continue to adapt to the changing economic landscape shaped by the Federal Reserve’s policies, low-interest loan programs serve as a valuable tool in providing relief to borrowers facing high borrowing costs. The success of programs like the MOBUCK$ initiative in Missouri and the agricultural investment program in Illinois underscores the effectiveness of government intervention in supporting key sectors such as agriculture and small business. By leveraging taxpayer funds to provide low-interest loans, states are able to stimulate private investment, generate economic activity, and help borrowers save thousands of dollars in interest payments, ultimately contributing to a more robust and resilient economy for all.