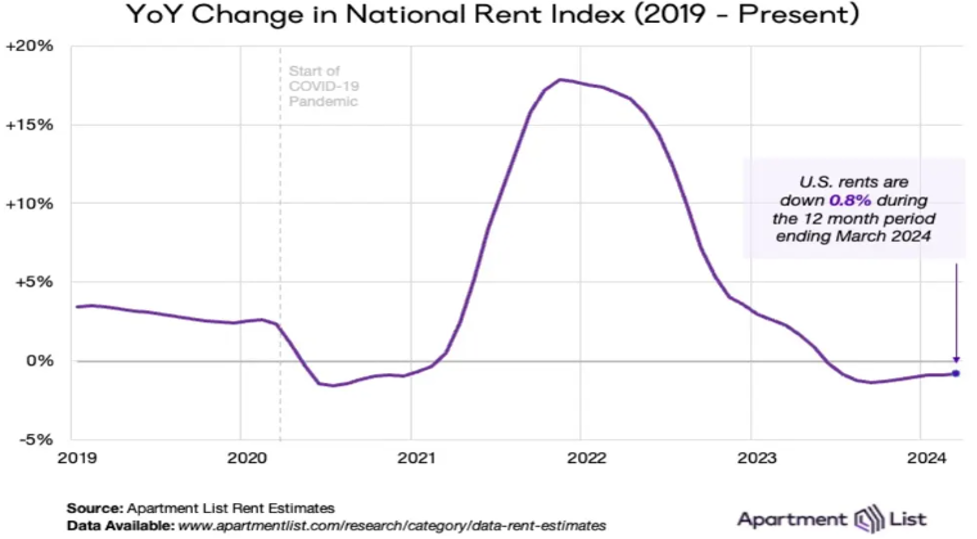

The last week of March saw several significant foreclosures, with properties in San Francisco, Mountain View, Washington D.C., and southern Florida being impacted. Leveraged loan delinquencies have surpassed 6%, approaching levels seen during past recessions. Office vacancies are at record highs, commercial real estate prices are plummeting, and a significant portion of loans have negative equity. Retail malls are struggling, and the multi-family space is experiencing falling rents. Banks are expected to report additions to their loan loss reserves in Q1 results in April, reflecting the challenges in the CRE sector.

Despite the growing issues in the CRE sector and economic challenges, equity prices continue to reach record highs. The S&P 500, DJIA, and Nasdaq have all hit new closing highs, driven by momentum rather than traditional valuation metrics. Industrial production, retail sales, exports, capital spending, and full-time job numbers are all showing negative trends. Despite this data, the Atlanta and St. Louis Federal Reserve District Banks are forecasting a significant +2.3% growth rate for Q1 GDP, which some analysts view as overly optimistic. Research houses like Rosenberg Research are projecting a -0.5% Q1 GDP growth based on recent data trends.

Home prices, which often drive the “wealth effect” for increased spending, are now showing negative trends as well. Consumer confidence is falling, with fewer people expecting economic improvement in the next six months. Growth forecasts from the Federal Reserve and Regional District Banks are mixed, with some Fed banks reporting weak manufacturing and service sector data in March, suggesting ongoing economic challenges. Consumer spending appears to be slowing, with retailers reporting lower sales and reduced demand.

Chairman Powell and the FOMC are waiting for more inflation data before considering lowering interest rates. Recent PCE inflation numbers showed a slight uptick year over year, but core inflation remains within the Fed’s target range. The core PCE Price Deflator is lower than the Core CPI Index, which is positive news for the Fed’s inflation concerns. Markets are increasingly betting on a potential rate cut in June, as inflation data continues to show disinflation trends.

The economy is showing cracks in various sectors, including manufacturing and consumer spending, with potential impacts on the financial sector in the coming months. Despite these challenges, the equities market continues to rise, with traditional valuation metrics suggesting overvaluation. The Fed’s growth forecasts for 2024 and lowered unemployment predictions contrast with emerging data indicating weakening retail sales, production, and housing. As inflation data continues to show disinflation trends, the odds of a June rate cut are increasing.