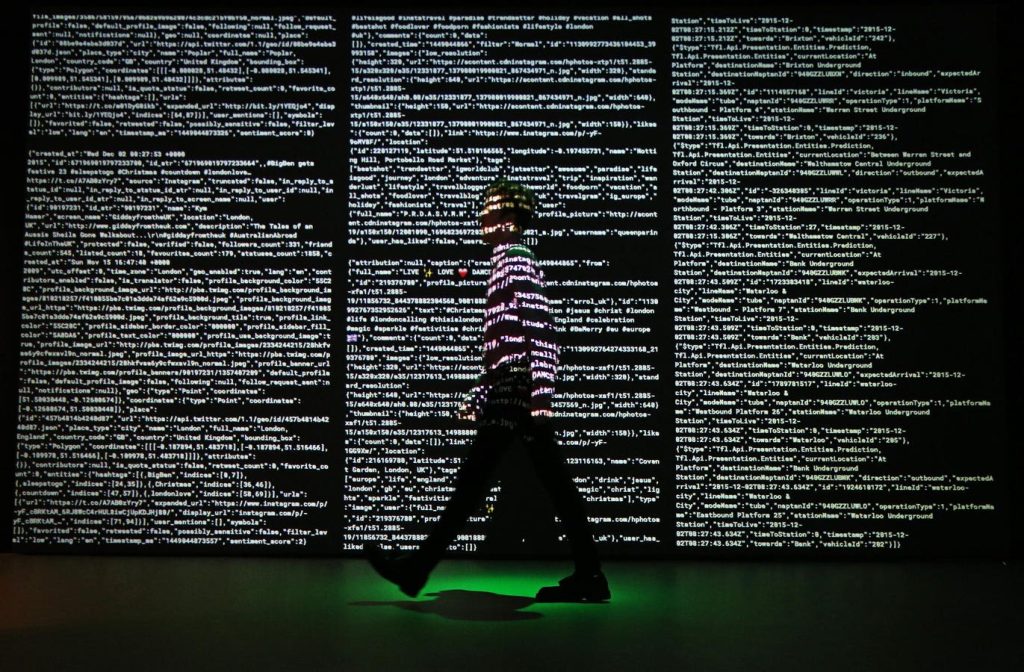

As the amount of data generated and managed by companies continues to skyrocket, the question of how to tax this valuable resource has become a hot topic of debate. With the rise of generative AI, which relies heavily on data, the importance of effectively managing and manipulating data has never been more critical for businesses’ success in the marketplace.

Taxing data is seen as a logical next step, considering the significant role it plays in customer acquisition, long-term forecasting, and service improvements for corporations. However, assigning a value to data is not as simple as it may seem. Different types of data hold varying levels of value, and what is considered useful to one industry may not be as valuable to another.

Legislators have attempted to tackle this issue by proposing ideas to assign value to data, such as implementing a tiered, per-head monthly excise tax on data collectors based on the number of consumers. These proposals vary from state to state and could pose challenges for corporations trying to navigate a complex tax landscape. The international implications of data taxation further complicate the issue, as different countries would likely have varying tax rates.

As the debate surrounding data taxation continues to unfold, there is a degree of uncertainty about how to effectively implement such policies. Corporations will need to stay vigilant and prepared for potential data taxes imposed by states or nations in the future. It will be crucial for companies to understand the data they have and the value it provides as they navigate this evolving landscape of data taxation.