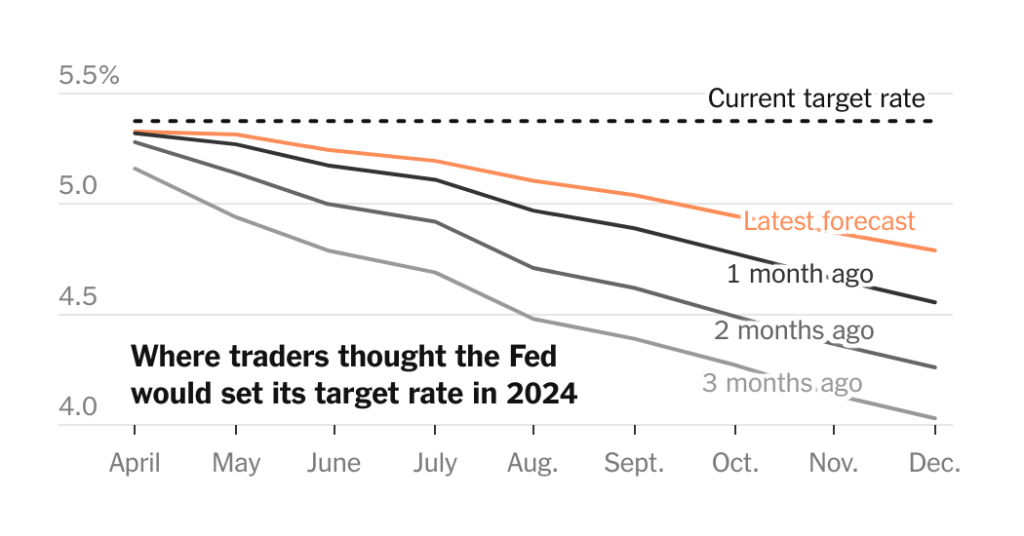

Investors at the start of 2024 were confident that the Federal Reserve would lower interest rates to around 4 percent by the end of the year. However, current market pricing now suggests that rates will end the year closer to 4.75 percent, indicating that the outlook for rate cuts is less dramatic. Policymakers are treading carefully as they consider how to respond to economic conditions. They aim to balance the risk of triggering a recession by keeping rates too high with the danger of cutting rates too early or aggressively, potentially fueling inflation and economic acceleration. While officials have maintained their forecast for 2024 rate cuts, they emphasize that they are not in a rush to lower rates.

Federal Reserve officials are closely monitoring inflation as they deliberate on when to reduce interest rates in 2024. If policymakers are confident that inflation will return to the 2 percent goal, they may be more inclined to cut rates even in a strong economy. Longer-term interest rate decisions may be influenced by factors such as labor force growth and productivity. If the economy experiences greater momentum due to factors like government infrastructure investment or technological advancements, interest rates may need to remain higher to ensure economic stability. A sustained vigorous economy might require interest rates higher than those seen in the past decade.

Some Fed officials have suggested that interest rates may remain higher in 2024 than initially projected. Despite forecasts for three rate cuts in 2024, there are concerns that inflation has stalled, with recent data showing signs of stagnation. However, many economists believe it is premature to be concerned about inflation’s slowdown, citing seasonal factors and overall progress. Fed Chair Jerome Powell has indicated caution regarding rate cuts, emphasizing the importance of patience. While there are sticky areas in inflation, they are viewed as isolated instances rather than indicative of a broader trend.

There is a growing belief among some economists and investors that interest rates could stay elevated in the coming years, contrary to Fed predictions. Fed projections suggest rates will fall to 3.1 percent by the end of 2026 and 2.6 percent in the long run. However, figures like former New York Fed President William Dudley and JPMorgan Chase CEO Jamie Dimon argue that rates may remain higher due to factors like sustained economic growth and societal changes. If rates remain elevated, borrowing costs including mortgages and credit cards are likely to remain higher, erasing hopes for a return to the extremely low rates seen in the past decade.

The potential decision by the Fed to keep interest rates higher for an extended period would have implications for borrowers. Cheaper mortgage rates and borrowing costs seen in the 2010s may not return if rates stay elevated. While this could signify a stronger economy that does not require emergency rate cuts, it may disappoint individuals seeking lower borrowing costs. Consumers, homeowners, and entrepreneurs who have been awaiting low interest rates may find themselves facing higher borrowing costs than expected if rates remain elevated, highlighting the impact of the Fed’s decisions on various sectors of the economy.