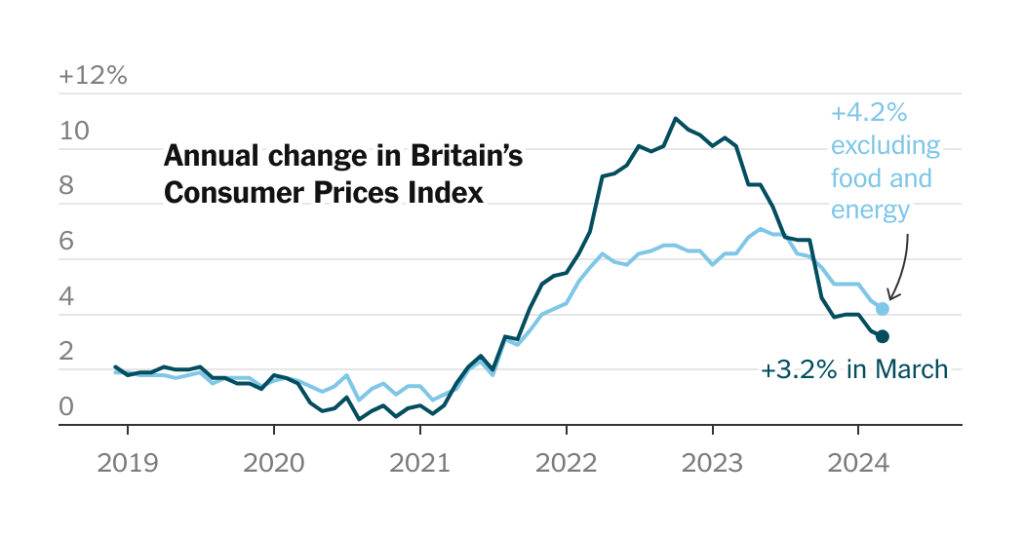

Consumer prices in Britain rose at the slowest rate in two and a half years, with inflation at 3.2 percent in the year through March. This was down from 3.4 percent in February but slightly higher than the expected 3.1 percent. Core inflation, which excludes volatile food and energy prices, was at 4.2 percent, a decrease from 4.5 percent the previous month. Economists anticipate inflation to continue slowing in the coming months, possibly dipping below the Bank of England’s 2 percent target, especially as household energy bills decrease.

The weakening economy has also led to a rise in Britain’s unemployment rate, adding pressure on the central bank to consider cutting interest rates. Jake Finney, an economist at PwC, noted the “difficult balancing act” facing the Bank of England. While slowing inflation may prompt the bank to lower rates in order to stimulate economic growth, policymakers are likely waiting for more concrete evidence of a sustainable return to target before making that decision. The Bank of England recently kept its key rate at 5.25 percent for the fifth consecutive meeting, reflecting a cautious approach in light of the uncertain economic conditions.

Similarly, the U.S. Federal Reserve has opted to maintain its current interest rates, with its top officials indicating a reluctance to cut rates too soon due to persistent inflationary pressures. The European Central Bank, on the other hand, has hinted at the possibility of lowering interest rates at its upcoming policy meeting in June, as inflation in the eurozone slows and the region’s economy struggles. This difference in monetary policy approaches reflects varying economic conditions and inflationary pressures across different regions.

The global trend of central banks adjusting interest rates in response to shifting economic conditions demonstrates the challenges faced by policymakers in balancing growth and inflation. While some central banks, like the Bank of England and the U.S. Federal Reserve, are exercising caution in considering rate cuts, others, such as the European Central Bank, are taking proactive steps to stimulate their economies through monetary policy adjustments. These divergent approaches underscore the complexity of managing inflation and growth in a rapidly changing economic environment.

As inflation eases in Britain and other parts of the world, central banks are closely monitoring economic indicators to determine the appropriate course of action. The current environment of slowing inflation and heightened economic uncertainty requires policymakers to carefully assess the risks and benefits of adjusting interest rates. By evaluating a range of economic data and trends, central banks can make informed decisions that support economic stability and growth while also managing inflationary pressures effectively.

In conclusion, the recent developments in inflation rates in Britain and other major economies highlight the challenges facing central banks as they navigate a complex economic landscape. With inflation slowing and economic growth uncertain, policymakers must carefully consider the impact of interest rate adjustments on various sectors of the economy. By closely monitoring key indicators and trends, central banks can develop strategies that support sustainable growth while managing inflation within target levels. The coming months will be crucial for central banks to assess the evolving economic conditions and make informed decisions to support economic recovery and stability.