The United States has signed a significant aid package for Ukraine, allowing the administration to seize Russian state assets in the U.S. and use them for the benefit of Kyiv. This could potentially provide an additional $5 billion in assistance for Ukraine from frozen Russian Central Bank holdings. The seizures would be carried out under the REPO Act, incorporated into the aid bill, but would require agreement from other G7 nations and the European Union before being implemented. The distinction between freezing and seizing assets is important, as frozen assets are immobilized but still belong to the country in question.

For over a year, officials from various countries have been deliberating on the legality of confiscating Russian assets and redirecting them to Ukraine. The new U.S. law mandates the president and Treasury Department to begin locating Russian assets in the U.S. within 90 days, with a report due to Congress within 180 days. A month after that period, the president can potentially seize Russian state assets within U.S. jurisdictions. However, the U.S. aims to proceed in consultation with global allies, which could slow down the process.

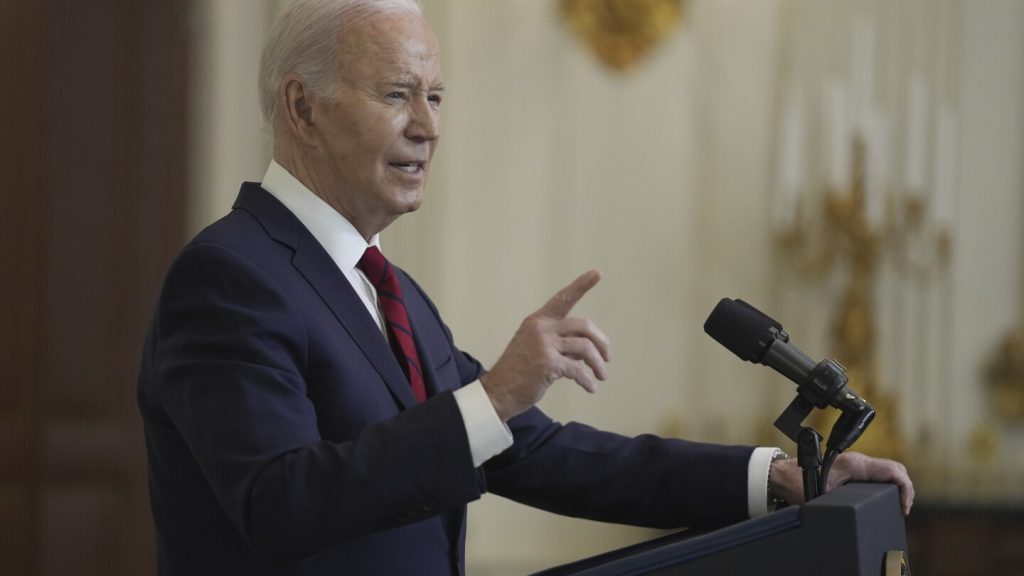

President Biden has the authority to determine how the seized assets can be used for Ukraine’s benefit, but must collaborate with other G7 members before taking action. The legislation emphasizes the importance of conducting any confiscation of Russian sovereign assets alongside international allies. The European Union has already started setting aside interest generated from frozen Russian central bank assets, estimating it could provide approximately 3 billion euros annually. However, there are reservations among some European leaders regarding the formal seizure of Russian assets in Europe.

Critics of the REPO Act argue that the weaponization of global finance against Russia could have negative repercussions, such as potentially harming the status of the U.S. dollar as the world’s dominant currency. There are concerns that confiscating Russian assets could lead other nations, like China, to reconsider holding reserves in U.S. dollars. The Heritage Foundation has criticized asset seizure, warning that it could expose the fragile U.S. economy to unintended consequences and risks for which the country may not be prepared. Russian authorities have also voiced objections, suggesting that the new law could undermine the global financial system.

The issue of seizing Russian assets is expected to be a key topic at the upcoming G7 leaders’ meeting in Italy, where the U.S. will aim to coordinate with allies on a collective approach. National security adviser Jake Sullivan emphasized the importance of a unified response from the G7 nations. As discussions continue, policymakers will need to weigh the potential benefits for Ukraine against the risks and implications for the global financial system. The decision to seize Russian assets will have far-reaching consequences, requiring careful consideration and collaboration among international partners.