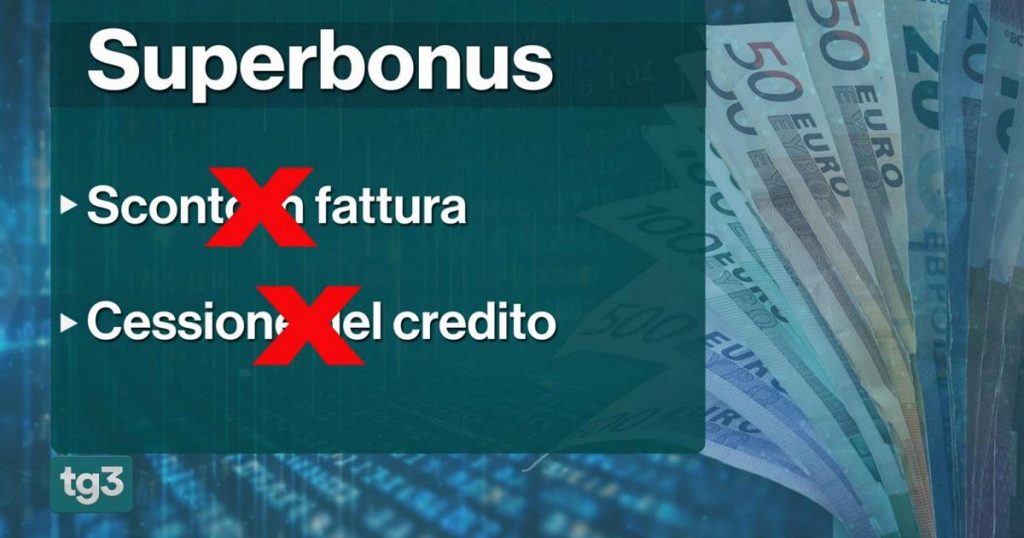

Minister of Economy Giancarlo Giorgetti joked with reporters that he will spend Easter with the “superbonus,” referring to the rising cost of the tax credit which reached 114 billion euros in February. Concerns over public finances led the Treasury to take action and introduce a new decree to permanently eliminate the tax credit and the transfer of credit, even for social housing and post-earthquake reconstruction projects. However, the tax deduction option will still remain available.

The elimination of the tax credit and credit transfer for the Superbonus may be softened for earthquake-hit areas. The government is reportedly fine-tuning the final details of the decree, taking into account requests received so far, especially from earthquake-affected areas and low-income individuals. This decision is being made with the understanding that there is little room for adjustments due to tight margins.

The Superbonus was originally introduced as an incentive to promote energy efficiency and renovations in Italy. However, the soaring cost of the program has raised concerns about its impact on public finances. By eliminating the option for tax credits and credit transfers and focusing solely on tax deductions, the government hopes to address these concerns and strike a balance between promoting energy efficiency and managing fiscal responsibilities.

The move to cancel the tax credit and credit transfer for the Superbonus has sparked debate among experts and stakeholders. While some support the decision as a necessary measure to rein in costs, others argue that it will have negative consequences for the construction and renovation sector. The government’s decision to consider exemptions for earthquake-affected areas and low-income individuals aims to mitigate some of these concerns and ensure that the impact of the changes is not overly burdensome.

The final version of the decree is still being fine-tuned, with the government carefully weighing the potential implications of the changes. The decision to focus on tax deductions as the primary incentive for the Superbonus reflects a shift towards a more sustainable and fiscally responsible approach to promoting energy efficiency in Italy. As the government continues to navigate the complex challenges of balancing economic growth with fiscal discipline, the fate of the Superbonus will remain a topic of ongoing debate and scrutiny.