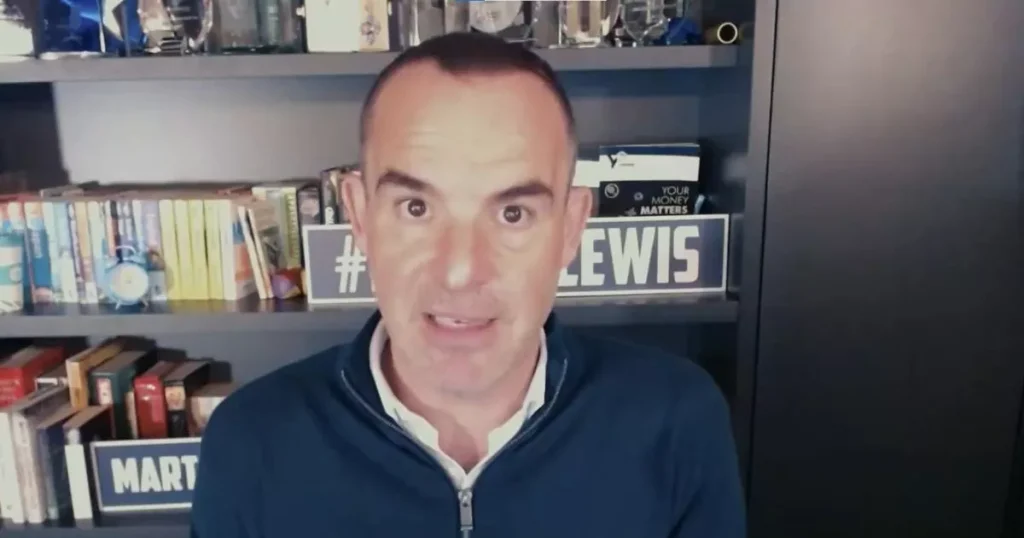

Martin Lewis, founder of Money Saving Expert, recently shared a video explaining the five key rules of inheritance tax. Inheritance tax is a levy imposed on assets left behind by someone who has passed away, including property, money, and possessions. The topic has been the subject of recent debate, with calls for its abolition. However, no changes have been made yet. Understandably, it can be difficult to navigate the rules and determine who is required to pay inheritance tax. Martin Lewis clarified the key points in his video earlier this year, emphasizing that it primarily affects affluent households. Most people will not have to pay inheritance tax when they die, as it is a tax that affects only a small percentage of homes.

The first rule Lewis explained is that anything left to a marital or civil partner is exempt from inheritance tax. However, this exemption does not apply to cohabiting couples, regardless of how long they’ve been together or how many children they have. The second rule states that there is no inheritance tax owed on the first £325,000 of an estate. If the total assets value less than this threshold, no tax is due. This threshold increases to £500,000 if the family home is left to children or grandchildren, including adopted, fostered, or stepchildren. However, this increase does not apply if the estate exceeds £2 million.

Lewis elaborated on the fourth rule, which allows individuals to leave any unused portion of their inheritance tax allowance to their spouse. This means that the spouse can combine both their own allowance and the deceased’s allowance, resulting in a larger amount that can be left untaxed. Lewis also mentioned strategies to reduce the amount of inheritance tax owed, such as giving gifts from annual income or taking advantage of various allowances. If the estate is still subject to inheritance tax, the rate is 40%.

In conclusion, inheritance tax is a complex levy that many people misunderstand. Martin Lewis’s video aims to simplify the key rules surrounding inheritance tax and dispel common misconceptions. The tax primarily affects wealthy households, and most people will not have to pay it upon their death. Understanding the exemptions and thresholds can help individuals plan their estate effectively and reduce their potential tax liability. By following the outlined rules and strategies, individuals can navigate the complexities of inheritance tax and ensure that their assets are passed on efficiently to their loved ones.