The state of Kansas is facing a conflict over proposed tax cuts between Democratic Gov. Laura Kelly and the Republican-controlled Legislature. The release of a new fiscal forecast has reinforced this dynamic, with lawmakers scheduled to reconvene after a spring break for the final days of their annual session. The forecast projects a slight trimming of previous estimates for tax collections in the current budget year, but a boost in projections for the next budget year. Despite the tax cuts approved by lawmakers, the state is expected to have more than $3.7 billion in surplus funds by June 2025.

The tax bill on Gov. Kelly’s desk would cut taxes by more than $1.5 billion over the next three years. Kelly has expressed concerns about the affordability of the tax cuts in the long term and has stated that she wanted to see the new fiscal forecast before making a decision. Republican leaders, on the other hand, are urging Kelly to sign the tax bill, with House Speaker Dan Hawkins stating that the new forecast should make it an easy decision for the governor. The bill would reduce individual income tax rates and eliminate income taxes on Social Security benefits, among other provisions.

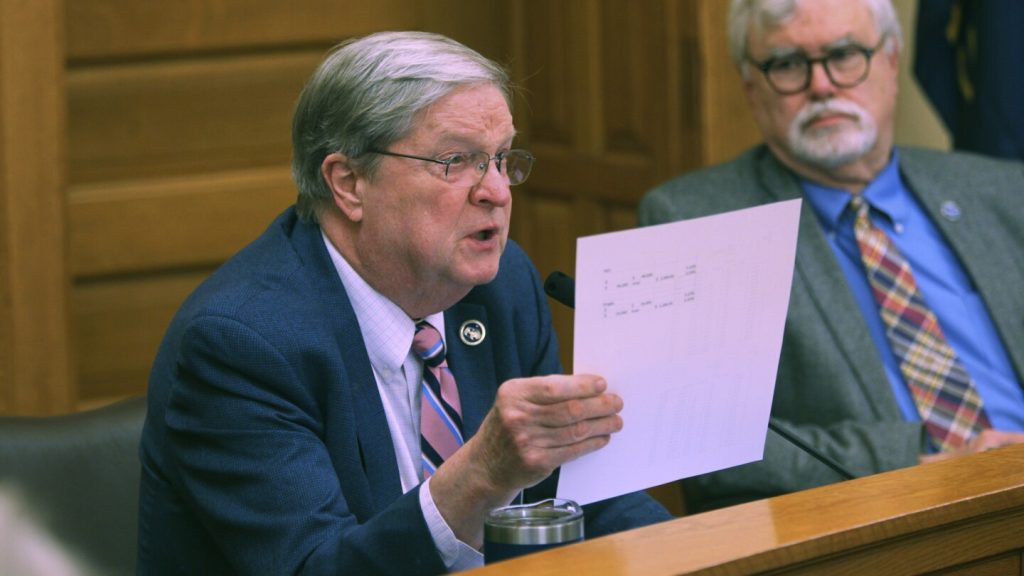

The proposed tax cuts have divided Democrats in the state, with some opposing the measure and echoing Kelly’s concerns, while others support it as providing tax relief for all classes of Kansas residents. The bill received approval in the House without any opposing votes, but the unity among House Democrats may not hold during a potential vote to override Kelly’s veto. House Minority Leader Vic Miller has expressed satisfaction with the final bill but is hesitant to ask Democrats to support a veto override if a better plan is not possible. The governor’s decision on whether to sign the tax bill will play a crucial role in the state’s financial future.

Overall, the state’s annual tax collections are projected to exceed $10 billion in both budget years, with a surplus of funds expected despite the proposed tax cuts. The new fiscal forecast indicates stability in the state’s finances, with additional interest earnings predicted on idle state funds. The conflict between Gov. Kelly and the Republican-controlled Legislature over the tax cuts highlights the ongoing debate over fiscal policy in Kansas. The final decision on the tax bill will have significant implications for the state’s budget and financial outlook in the coming years.