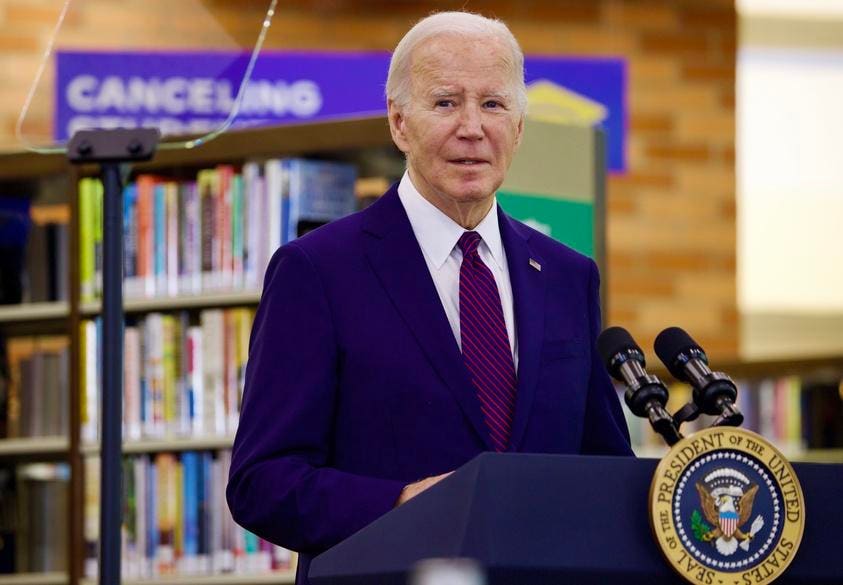

In the midst of an election year, President Biden has been championing his administration’s efforts in providing loan forgiveness to eligible borrowers. While a plan to forgive $10,000 to $20,000 in federal student debt was rejected by the Supreme Court in 2023, significant progress has been made since then, especially for those in public service or on income-driven repayment plans.

As of March 2024, the Biden administration has approved a substantial amount of loan forgiveness, including $45.6 billion for over 930,500 borrowers through income-driven repayment plan improvements, $22.5 billion for more than 1.3 million borrowers who were misled by their schools, $11.7 billion for almost 513,000 disabled borrowers, and $1.7 billion for 29,700 borrowers through administrative adjustments to payment counts.

Additionally, forgiveness of up to $6 billion has been granted to 78,000 public service workers, on top of the $1.2 billion already approved for almost 153,000 borrowers on the Saving on a Valuable Education (SAVE) plan. It is important to note that much of this forgiveness is based on existing programs, with some specifically resulting from the Biden Administration’s actions.

Looking ahead, the Biden administration is still processing one-time IDR account adjustments that will potentially benefit 3.6 million borrowers in the Direct Loan Program. These adjustments could lead to partial or full forgiveness of loans for many borrowers, giving them credit toward federal student loan forgiveness.

The upcoming election cycle could also influence future forgiveness initiatives, potentially impacting rules related to the discharge of debt for borrowers in financial distress. The inclusion of student loans in bankruptcy proceedings may become more feasible, as there is a trend towards increased consideration of such cases for partial or full discharge.

Furthermore, the Saving on a Valuable Education (SAVE) Plan has unlocked additional forgiveness opportunities for federal student loan borrowers. This income-driven repayment plan offers benefits such as loan forgiveness in as little as 10 years, an increased income exemption limit for $0 monthly payments, and the absence of unpaid interest accumulation on loans.

Ultimately, more student loan forgiveness is in progress, thanks to various executive actions and repayment plan adjustments. Borrowers in public service and those affected by closed colleges can expect continued relief through programs like Public Service Loan Forgiveness. While forgiveness may not happen all at once, there are promising developments on the horizon for borrowers seeking relief from their student debt.