The minimum guaranteed coupon rates for the third issuance of the BTP Valore will start at 3.25% for the first three years, then increase to 4% until the bond’s maturity in 6 years. The Treasury Department of the Ministry of Economy and Finance announced that the final coupon rates will be disclosed after the placement, and they may be either confirmed or increased based on market conditions at the time of the issuance closure. The BTP Valore, targeted at small savers, offers quarterly nominal coupons and a 6-year maturity with an additional final premium of 0.7% of the invested capital.

The government is looking to attract small investors with the BTP Valore, offering a steady return on their investments with the guaranteed minimum coupon rates. Small savers can benefit from the quarterly coupon payouts and the additional final premium at the bond’s maturity. The interest rates are competitive compared to other investment options in the market, providing a stable and relatively low-risk investment opportunity for individuals looking to grow their savings over the 6-year period.

The BTP Valore is part of the government’s strategy to finance public spending by issuing bonds targeted at retail investors. This allows the government to diversify its sources of funding and reduce its reliance on traditional financial institutions. By offering attractive terms to small savers, the government aims to increase participation in the public debt market and broaden the investor base, which can contribute to the stability and liquidity of the market.

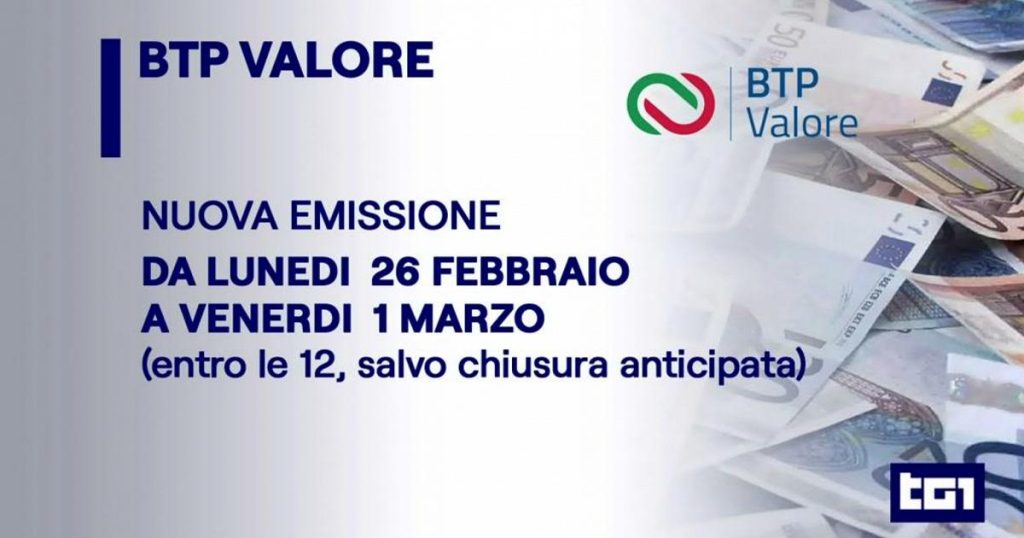

The BTP Valore issuance is scheduled to start on the following Monday, and investors will have the opportunity to participate in the bond offering. The final coupon rates will be determined after the placement, taking into account market conditions at the time of the issuance closure. Investors should carefully consider the terms of the bond and the potential risks before making an investment decision, as the rates may be subject to revision based on market conditions.

Overall, the BTP Valore presents an opportunity for small savers to invest in a government bond with guaranteed minimum coupon rates and a 6-year maturity period. The bond offers quarterly coupon payments and an additional final premium, providing a predictable return on investment for individuals looking to grow their savings. Investors can participate in the upcoming issuance starting on the following Monday, with the final coupon rates to be determined after the placement based on market conditions.