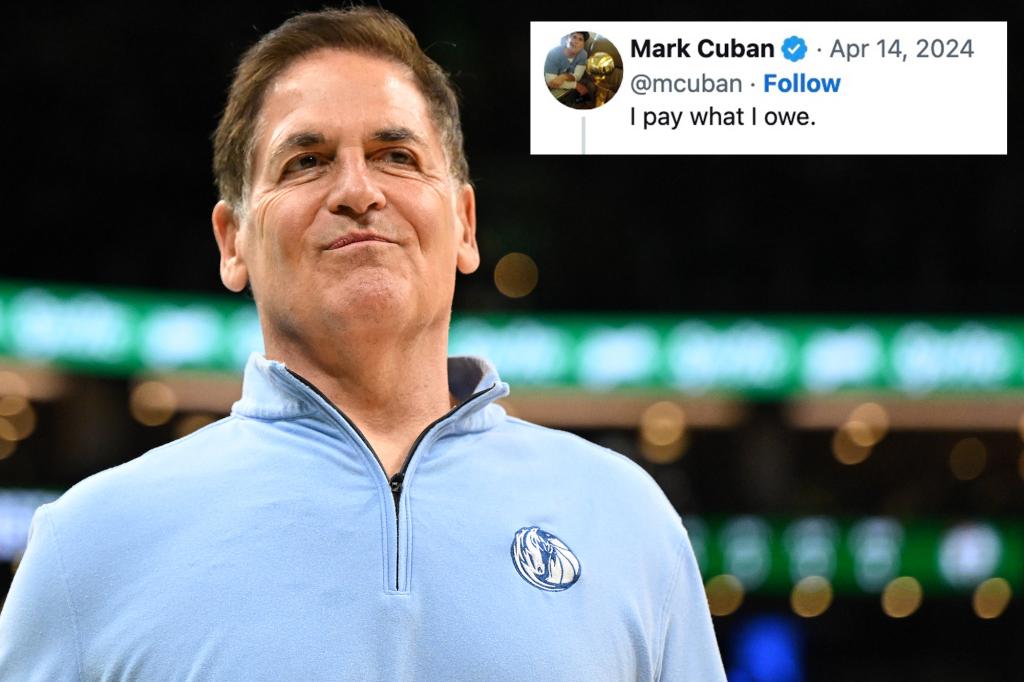

Billionaire Mark Cuban recently expressed pride in paying $275.9 million in taxes to the IRS, following criticism of former President Trump’s tax cut policies. The Dallas Mavericks owner engaged in a social media exchange with an OutKick writer, Ian Miller, who questioned whether Cuban or his corporations paid more than required taxes to contribute their “fair share.” Cuban’s response highlighted his belief in fulfilling his tax obligations as a form of gratitude for the benefits he has received from the country. Despite further commentary and jokes from others on social media, Cuban emphasized his sense of patriotism in paying taxes after military service.

Cuban’s decision to openly discuss the amount of taxes he pays was not the first time he had been transparent about his views on taxation. In a 2019 interview with Neil Cavuto, Cuban indicated his willingness to pay more taxes, considering it a patriotic duty after serving in the military. However, he expressed concerns over the proposed tax policies of 2020 Democratic hopefuls Elizabeth Warren and Bernie Sanders, questioning the government’s prioritization of spending once the taxes are collected. Cuban’s direct interactions on social media and public statements offer insights into his perspective on tax obligations as a wealthy individual.

The online exchange between Cuban and Miller also invited commentary from other social media users, including prominent figures like Grabien founder Tom Elliot and former investment banker Carol Roth. These individuals raised questions and made jokes about the effectiveness of Cuban’s tax payment in addressing the national debt and the allocation of government spending. Cuban corrected the initial total amount of $288 million he claimed to have paid, emphasizing accuracy in reporting his tax contributions and highlighting his sense of pride in supporting the country through taxes.

In response to the skepticism and inquiries raised by various individuals regarding his tax payments, Cuban reiterated his commitment to fulfilling his tax obligations, acknowledging that he does not expect all of the tax revenue to be used wisely by the government. Despite concerns about how the government handles tax revenue and spending priorities, Cuban emphasized the importance of patriotic duty in paying taxes, alongside military service. The exchange on social media and subsequent clarifications from Cuban shed light on his beliefs about taxation and his willingness to engage in public discussions about the topic.

While some criticized Cuban for not paying more than required taxes or for his perceived influence on government spending decisions, others showed support for his transparency and dedication to meeting his tax obligations. Syndicated radio host Joe “Pags” Pagliarulo expressed trust in Cuban’s ability to create jobs, businesses, and contribute to research and development with his earnings, highlighting a common debate on the role of wealthy individuals in economic growth. Despite the differing opinions raised, Cuban’s statements and actions reflect a personal commitment to paying taxes and contributing to the country’s finances as a form of civic duty.

Ultimately, Cuban’s public statements on taxation, patriotism, and government spending reveal his perspective as a wealthy individual on fulfilling tax obligations, questioning government priorities, and engaging in discussions about financial contributions to the country. Through social media interactions, interviews, and clarifications, Cuban demonstrates a willingness to engage with critics, defend his beliefs, and emphasize the importance of supporting the country through taxes. The debate surrounding his tax payments and views on taxation provides insight into the broader discussions on wealth, taxes, and civic responsibility in society.