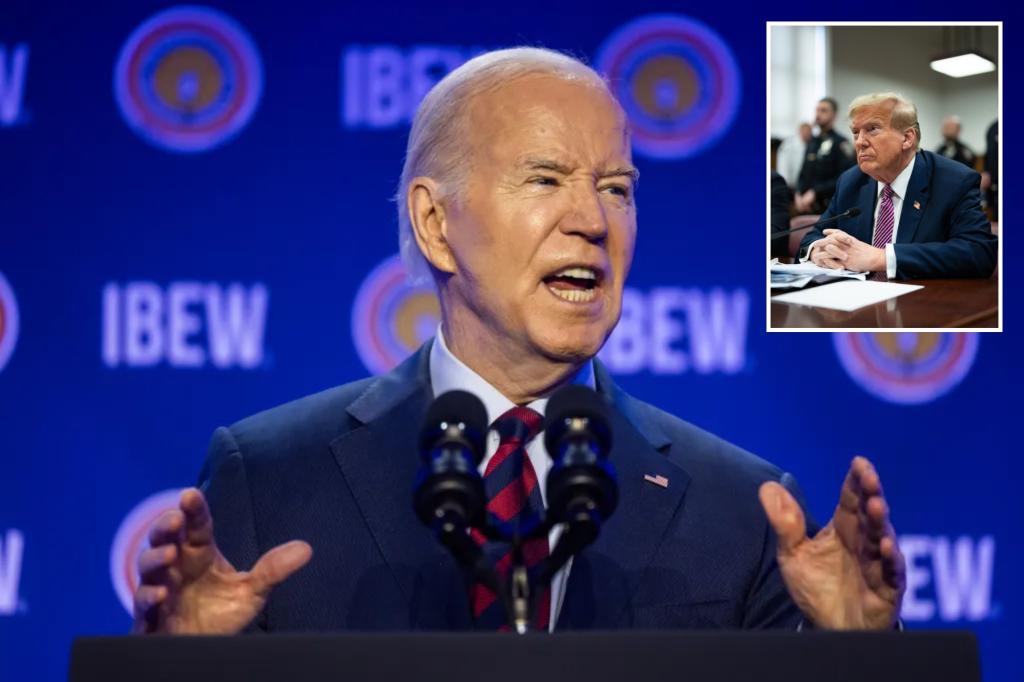

In a speech to electrical union members in Washington, President Biden criticized former President Donald Trump’s 2017 Tax Cuts and Jobs Act, calling it a giveaway to the wealthy. Biden stated that if he is re-elected, the tax cuts will be allowed to expire next year and will not be renewed, potentially resulting in higher taxes for middle-class and low-income Americans. Despite his promise not to increase taxes on people earning less than $400,000 annually, it is unclear if this decision was a formal policy position or an off-the-cuff remark.

The Tax Foundation has indicated that allowing the Tax Cuts and Jobs Act to lapse could lead to across-the-board income tax hikes for the majority of Americans. The top 1% of earners saw a decrease in their average federal income tax rate due to the law, from 26.8% to 25.4%. However, other income groups also experienced tax cuts, with the next highest 4% of earners seeing a reduction from 19.5% to 17.3%, and those between the 10% and 5% income thresholds experiencing a drop from 14.3% to 13.1%.

Democrats have pointed out that while the Tax Cuts and Jobs Act predominantly benefited higher-income individuals due to their higher earnings, lower-income individuals also experienced tax reductions. Poorer individuals had their tax rates decreased, with the bottom 50% of filers seeing a reduction from 4% to 3.4%, and the quarter of Americans between the top 50% and 75% of earners witnessing a decrease from 8.1% to 6.9%. The Tax Foundation has highlighted the potential consequences of allowing the tax law to expire, urging Congress to take action to prevent tax hikes for Americans.

President Biden’s announcement regarding the fate of Donald Trump’s tax cuts comes amid preparations for the expected November election rematch between Biden and Trump. Biden, who has been critical of the tax law and its impact on income inequality, reiterated his commitment to not raising taxes on those earning less than $400,000 annually. The White House and Biden campaign have not yet issued a formal comment on Biden’s statements regarding the tax cuts, leaving some uncertainty surrounding the implementation and implications of his proposed tax policy changes.

The expiration of the Tax Cuts and Jobs Act next year, if Biden is re-elected, could mark a significant shift in tax policy that would impact a wide range of Americans. The decision to allow the tax cuts to lapse is seen as a means to address concerns regarding income inequality and the distribution of tax benefits among different income groups. While higher-income individuals benefited the most from the tax cuts, lower and middle-income earners also experienced reductions in their tax rates, underscoring the complexity and potential implications of Biden’s proposed tax policy changes. As the debate over tax policy continues, the outcome of the upcoming election will play a crucial role in shaping the future of American tax policy and its impact on individuals across the income spectrum.