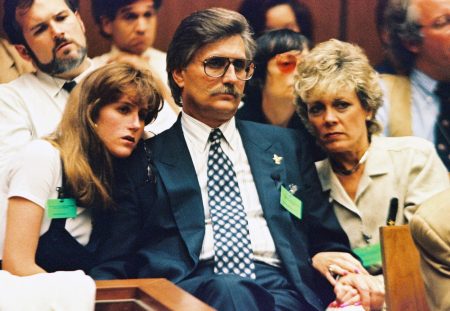

In 2018, a full-time graduate student and part-time course designer at a university decided to launch a side hustle selling card games on Amazon to help people build “human skills” like emotional intelligence and critical thinking. This side hustle sustained her through the next five years while she completed her Ph.D. Despite initially lacking knowledge about running a business, she now has multiple income streams, including speaking engagements, teaching online courses about EQ, lecturing at the University of California Irvine, freelance business consulting, and selling Mind Brain Emotion card games through her website and on Amazon, bringing in $142,000 a month from the Amazon business alone.

The entrepreneur advises aspiring entrepreneurs to avoid three common mistakes when creating side hustles. Firstly, she emphasizes not to overcomplicate the product and to focus on understanding the core value of the brand. By asking key questions about the fundamental need the product fulfills and taking minimal steps to get there, entrepreneurs can develop straightforward solutions that meet customer needs. Real-world feedback should guide further iterations instead of relying on assumptions. Simplicity can be refreshing in a crowded market.

Secondly, the importance of not settling for subpar service, even when on a budget, is highlighted. While collaborating with fellow side hustlers can save money and help grow the business, it is essential to be diligent in choosing who to work with to ensure consistent quality. The entrepreneur shares her experiences with social media managers and SEO vendors who failed to deliver the expected service due to staff changes and lack of experience. Making necessary changes and upgrades to service providers is crucial for maintaining business success.

Thirdly, she advises against solely relying on networking to advance ideas. While seeking advice and mentorship from incubators and advisers can be beneficial, it can also lead to confusion and overwhelm if there is a lack of clarity in the feedback received. Too much external validation may dilute one’s vision and hinder progress. The entrepreneur encourages individuals to trust their own judgment and take ownership of their journey, seeking guidance while maintaining independence in decision-making.

Dr. Jenny Woo is a Harvard-trained educator, EQ researcher, and founder and CEO of Mind Brain Emotion. She has developed a series of educational card games and mental health tools to help individuals develop human skills in the era of artificial intelligence. Her award-winning card games are utilized in over 50 countries. By sharing her experiences and insights, she aims to inspire and guide fellow entrepreneurs towards building successful side hustles and navigating the challenges along the way.

For individuals looking to make extra money outside of their day jobs, CNBC offers an online course on how to earn passive income online. The course covers common passive income streams, tips for getting started, and real-life success stories. By registering for the course, individuals can learn valuable strategies for generating additional income. Additionally, signing up for CNBC Make It’s newsletter provides tips and tricks for success in various aspects of life, including work and finances. By staying informed and learning from successful entrepreneurs like Dr. Jenny Woo, individuals can enhance their entrepreneurial endeavors and achieve their goals.