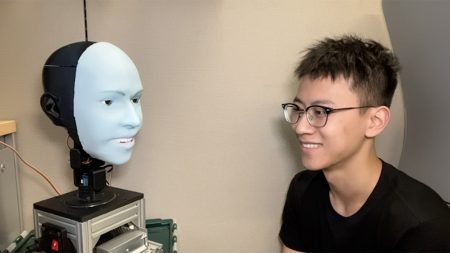

Prosopometamorphopsia (PMO) is a rare condition that causes facial features to appear distorted. The term comes from the Greek words for face and perceptual distortions, with symptoms varying from case to case and affecting the shape, size, color, and position of facial features. PMO can last for days, weeks, or even years, and a recent Dartmouth study published in The Lancet explores a unique case of a 58-year-old male patient with PMO. This patient sees faces without distortions on screens and paper, but sees distorted, “demonic” faces in-person, making his case particularly rare and providing researchers with a unique opportunity to accurately depict his distortions.

The study involved taking a photograph of a person’s face and showing it to the patient on a computer screen while he looked at the real face of the same person. By obtaining real-time feedback from the patient on how the faces differed, researchers could modify the photograph to match the distortions perceived by the patient, allowing them to visualize his real-time perception of the distortions. This method provided a more accurate depiction of the patient’s distortions compared to previous studies where patients with PMO could not accurately assess visualizations of their distortions due to distortions being present in the visualizations as well.

The co-authors of the study have encountered cases in which individuals with PMO were misdiagnosed with psychiatric conditions such as schizophrenia, leading to unnecessary treatments with anti-psychotics. Many people with PMO may not disclose their condition to others out of fear of being misunderstood or stigmatized. The lack of understanding surrounding PMO poses a challenge for those affected by the condition, as their distortions may be perceived as symptoms of a psychiatric disorder rather than a problem of the visual system. The researchers aim to increase public awareness of PMO through their study and highlight the importance of accurate diagnosis and treatment for individuals with the condition.

While PMO remains a rare and poorly understood condition, research like the Dartmouth study can help shed light on the experiences of individuals living with facial distortions. By accurately visualizing the distortions perceived by patients with PMO, researchers can provide valuable insights into the condition and potentially improve diagnosis and treatment strategies. Increased awareness and understanding of PMO can help reduce stigma and ensure that individuals affected by the condition receive the support and care they need to navigate their unique challenges. Through ongoing research and advocacy efforts, researchers and health professionals can work towards addressing the needs of individuals with PMO and promoting greater awareness and understanding of this rare condition.