A solar eclipse will occur in North America on April 8, 2024, with millions of Americans preparing for the event. The line of totality will stretch across 15 states, with a partial eclipse visible in all continental U.S. states. The eclipse path will travel from Mexico through Texas to Ohio, Canada, and Maine. The duration of the eclipse will vary depending on the location, with some areas experiencing totality for more than four minutes.

Dr. William Blair, an astrophysicist at Johns Hopkins University, described the upcoming solar eclipse as a “pretty good” one due to the orbit and distance of the moon. Solar eclipses are rare events that occur when the sun, moon, and Earth align almost perfectly. The next solar eclipse in the U.S. is not expected until August 23, 2044. NASA describes solar eclipses as a “convenient coincidence” because the sun and moon appear nearly the same size in the sky, allowing for a spectacular show when they align.

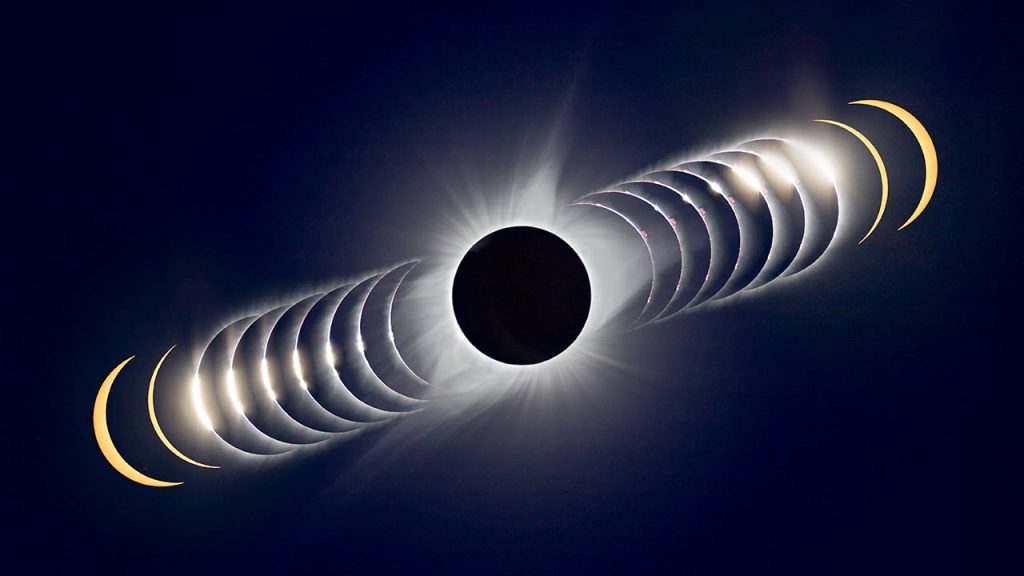

Blair emphasized the significance of witnessing a solar eclipse, as everything must align perfectly for the event to occur. The best view will be in the zone of totality, where the corona – the region around the bright disk of the sun – is illuminated. When the sun is covered during an eclipse, the corona becomes visible, creating a magical sight. It is essential to use protective eyewear when viewing a solar eclipse to prevent eye damage from direct exposure to the sun’s intense rays. Safe viewing is crucial, as even a momentary look at a partially eclipsed sun can cause permanent blindness.

Solar Eyeglasses, a California-based seller of AAS-approved and ISO-certified solar eclipse glasses, experienced a significant increase in revenue and units sold in anticipation of the 2024 eclipse. The public is reminded to never look directly at the sun without specialized eyewear for solar viewing, as regular sunglasses do not provide adequate protection. Understanding the timing of when to wear protective eyewear is essential to prevent eye damage. Children can be provided with an extra layer of protection by using paper plates to block extra light during the eclipse.

Alternative methods for viewing the eclipse include looking through objects like pasta spoons or colanders with holes punched into them, which can project the partial phases of the eclipse onto the ground or a sheet of paper. Blair encourages people to experience the zone of totality, as it will be a rare opportunity to witness a solar eclipse up close. The anticipation for the 2024 eclipse is high, with many eager to observe this unique celestial event. The magical sight of the sun’s corona during totality and the intricate details of the eclipse phases make for an unforgettable experience.